what's happenging

politics Feb. 17, 2026

Trump says Board of Peace will unveil $5 billion in Gaza reconstruction pledges at inaugural meeting

Donald Trump announced that the newly proposed Board of Peace will unveil $5 billion in Gaza reconstruction pledges at its inaugural meeting. The initiative aims to mobilize global funding and coordinate rebuilding efforts amid ongoing humanitarian concerns.

Just In

technology Dec. 23, 2025

Uber and Waymo Launch Robotaxi Service for Passengers in Atlanta

sports Jan. 1, 2026

Patriots Say Criminal Cases Facing Diggs, Barmore Won’t Distract Them Ahead of Regular-Season Finale

business Dec. 26, 2025

Switzerland Shifts to Zero Interest Rates

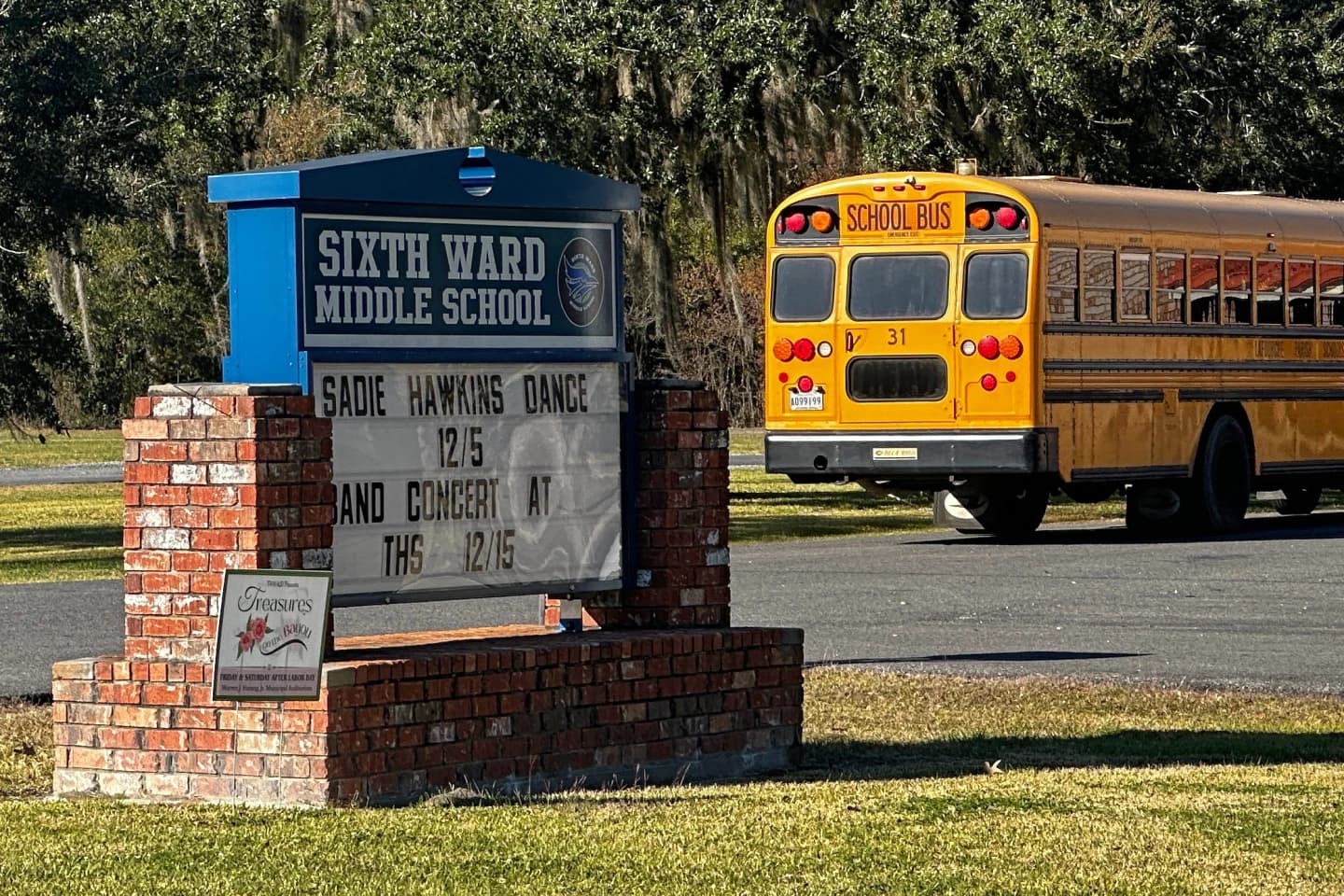

education Dec. 23, 2025

Community Schools Provide Far More Than Classroom Instruction

business Dec. 22, 2025

Greenland's Bold Invitation: Discover the Last Untouched Frontier

Latest

Democrats keep 2024 election review under wraps, saying a public rehash won’t help them win in 2026

FACT FOCUS: Trump says tariffs have created an economic miracle. The facts tell a different story

Trump Urges America to Move On From Epstein — But Political Fallout Persists

Recent News

Latest

politics Dec. 19, 2025

US Justice Department sues 3 states, District of Columbia for voter data

The U.S. Justice Department has filed lawsuits against three states and the District of Columbia over alleged violations of voter data sharing. The cases challenge the withholding of voter information under federal law.

politics Dec. 17, 2025

Former Crimson Tide quarterback AJ McCarron ends campaign for Alabama lieutenant governor

Former University of Alabama quarterback AJ McCarron has ended his Republican campaign for Alabama lieutenant governor to pursue a new football-related opportunity, saying the new role will require his full focus and leaving open the possibility of future political involvement.

politics Dec. 18, 2025

Jack Smith tells lawmakers his team developed ‘proof beyond a reasonable doubt’ against Trump

Former special counsel Jack Smith told lawmakers in a closed-door House Judiciary Committee deposition that his team “developed proof beyond a reasonable doubt” that President Donald Trump criminally conspired to overturn the 2020 election and broke federal laws on classified documents, defending his prosecutorial decisions as grounded in evidence and law

politics Dec. 24, 2025

Ohio governor ‘reluctantly’ signs bill eliminating grace period for late ballots

Ohio Governor Mike DeWine has reluctantly signed a bill that eliminates the grace period for late ballots. The decision has sparked debate over voter access and election integrity.

Health

health Dec. 22, 2025

Another HIV Vaccine Fails in Global Trial, Deepening Scientific Frustration

health Dec. 24, 2025

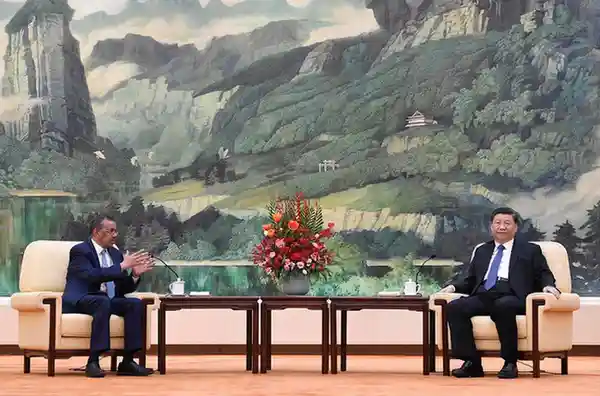

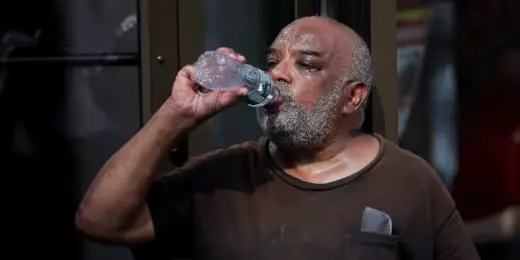

Oxygen Access: The Overlooked Lifesaver in Global Covid-19 Response

health Dec. 24, 2025

Medical Societies File Lawsuit Against Robert F. Kennedy Jr. and HHS Over 'Dangerous' Vaccine Misinformation

Science

scienceDec. 23, 2025

Genetically Modified Bacteria Convert Plastic Waste Into Valuable Pain Relievers

scienceDec. 21, 2025

World's Largest Digital Camera Unveils Stunning First Images of Galaxies and Celestial Clashes

scienceDec. 22, 2025